Stock prices always move up and down. No matter how strong a stock is, it will experience temporary declines due to profit booking, negative sentiment, or market correction. This is where traders try to grab the opportunity. But to capture it, traders have to identify when a falling stock begins to recover.

Spotting recovery early can offer better entry prices and an improved risk-reward ratio. Many traders rely on indicators, but price action can reveal signs of recovery before the lagging tools respond. One of such price action patterns is the two-candle recovery setup. We will explore how the two-candle setup works and how traders use it to identify potential reversals.

What is a two-candle recovery setup?

A two-candle recovery setup appears when a strong bearish candle is followed by a strong bullish candle, which signals a potential shift in momentum. In such setups, the first candle shows aggressive selling pressure. The second candle shows strong buying interest that overtakes the previous high.

This represents that the demand is returning. Although the pattern signals possible recovery, it does not guarantee the reversal.

The reliability of the pattern increases when the pattern forms near:

- Key support levels

- Demand zones

- Oversold conditions

- High-volume areas

Common two-candle patterns that signal recovery

There are many two-candle patterns that are recognised by the traders. We will discuss the most common patterns that can be seen on the price chart.

- Bullish engulfing pattern

The bullish engulfing pattern is one of the most common patterns that appear after a short-term decline. In this pattern, the first candle is bearish, signalling aggressive selling. The second candle is a strong bullish candle that engulfs the first bearish candle. The second candle represents that the buyers have stepped in.

Why traders watch it:

- Shows a strong shift in momentum

- Indicates potential demand zone reaction

- Marks the beginning of short-term recovery

Traders usually enter after the completion of the second candle to avoid false signals.

- Piercing line pattern

This piercing pattern forms when the first candle is strongly bearish, and the second candle opens with a gap-down but recovers and closes above the midpoint of the bearish candle. This pattern indicates that the sellers push the prices during the formation of the first candle and in the initial phase of the second candle, but buyers regain the strength during the session and recover the price.

It reflects weakening selling pressure and increasing demand. This setup is preferred by swing traders looking for early recovery entries after pullbacks.

- Bullish outside bar

A Bullish Outside Bar occurs when the second candle breaks both the high and low of the previous candle and closes strongly bullish. This pattern signals high volatility and strong buyer dominance. Traders interpret this as a sign that the stock may attempt to stabilise and recover from recent declines. Refer to the figure below for the bullish outside bar pattern.

How traders trade the recovery setup

You can follow the structured approach given below, in order to make the most out of these moves and reduce emotional entries.

- Identify prior weakness – The stock should show a clear short-term decline or pullback.

- Wait for Confirmation – You must wait for the second candle to close. Entering mid-session increases false signals.

- Look for Confluence – if the pattern appears near support zones, trendline support, moving averages, volume expansion, or RSI moving out of oversold territory, then the probability of reversal increases.

- Plan Risk Management – Place stop-loss below the recent swing low.

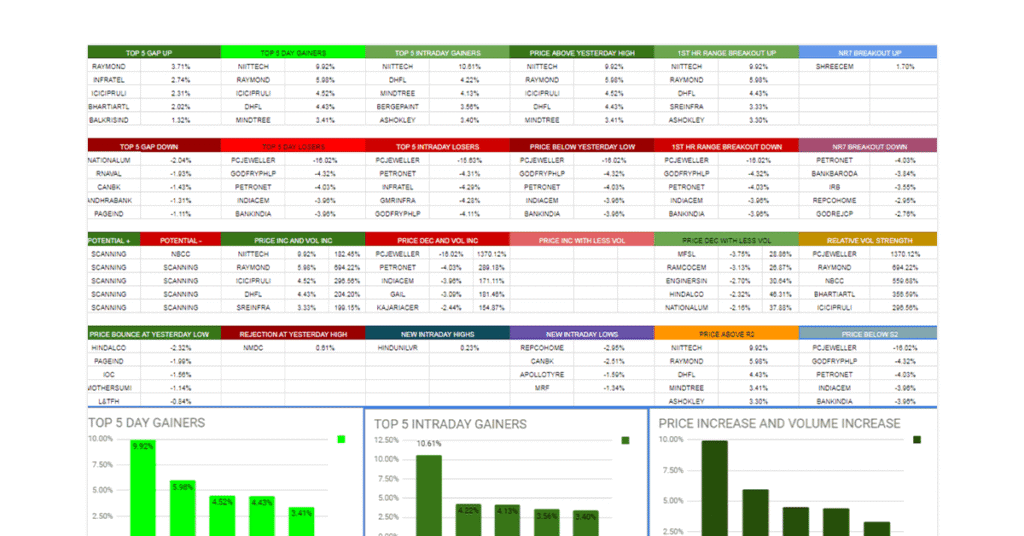

Nowadays, traders use a screener for Indian stocks to filter companies that have declined recently but are forming bullish engulfing or piercing patterns with strong volume.

Final thoughts

A two-candle recovery setup offers traders an early signal that selling pressure may be weakening. When combined with strong support levels and volume confirmation, it can provide attractive entry opportunities.

But no pattern ensures success. Since markets are still erratic, effective risk management is crucial.